Upstream

In 2021, KMG continued to honour its commitment under the OPEC+ agreement to cut production as a way to rein in global oil demand and prices.

In order to maintain social and financial stability in some regions of operation, the Company partnered with Kazakhstan’s Ministry of Energy to redistribute oil production restrictions within KMG Group.

Oil and gas are produced by KMG’s operating assets and megaprojects where KMG has non-operating interests.

KMG participates in three major oil and condensate production projects in Kazakhstan, with interests of 20%, 10% and 8.44% in Tengiz, Karachaganak and Kashagan, respectively.

The Company partners with the world’s oil giants to deliver on its megaprojects. These giants include Chevron Corporation, Exxon Mobil Corporation, Royal Dutch Shell plc, Eni S.p.A., TOTAL S.A., INPEX CORPORATION, China National Petroleum Corporation (CNPC) and LUKOIL.

| Operating assets | KMG’s interest, % |

|---|---|

| | 100 |

| JSC Embamunaigas | 100 |

| JSC Mangistaumunaigaz | 50 |

| JSC Karazhanbasmunai | 50 |

| JV Kazgermunai LLP | 50 |

| JSC PetroKazakhstan Inc. | 33 |

| Kazakhturkmunay LLP | 100 |

| Kazakhoil Aktobe LLP | 50 |

| Amangeldy Gas LLP (condensate) | 100 |

| Urikhtau Operating LLP | 100 |

| Non-operating assets (megaprojects) | KMG’s interest, % |

|---|---|

| Tengizchevroil LLP | 20 |

| North Caspian Operating Company N.V. | 8.44 |

| Karachaganak Petroleum Operating B.V. | 10 |

Oil production

In 2021, as part of Kazakhstan’s commitment to cut oil supply under the OPEC+ agreement, KMG reduced its oil and condensate output by 900 ths tonnes vs the previously approved annual targets. KMG’s total output was 21.6 mln tonnes or 444 ths bbl per day, down 0.5% year-on-year. Despite that, KMG remains the national leader in Kazakhstan’s oil and gas industry, accounting for one third of the country’s oil and condensate production.

KMG has a balanced portfolio of upstream assets with a significant growth potential. The share of operating projects and megaprojects in its total oil and condensate production was 64% (14 mln tonnes) and 36% (7.7 mln tonnes), respectively.

| Indicator | 2019 | 2020 | 2021 |

|---|---|---|---|

| Oil and gas condensate production | 23,618 | 21,752 | 21,654 |

| Operating assets | 15,476 | 14,113 | 13,965 |

| JSC OzenMunaiGas | 5,586 | 5,347 | 5,332 |

| JSC Embamunaigas | 2,900 | 2,601 | 2,522 |

| JSC Mangistaumunaigaz | 3,204 | 2,977 | 2,944 |

| JV Kazgermunai LLP | 1,114 | 778 | 727 |

| JSC Karazhanbasmunai | 1,082 | 1,001 | 1,048 |

| JSC PetroKazakhstan Inc. | 844 | 661 | 600 |

| Kazakhoil Aktobe LLP | 320 | 295 | 298 |

| Kazakhturkmunay LLP | 409 | 432 | 434 |

| Amangeldy Gas LLP (KTG) | 17 | 15 | 14 |

| Urikhtau Operating LLP | 0 | 6 | 47 |

| Megaprojects | 8,142 | 7,639 | 7,654 |

| Tengizchevroil LLP | 5,958 | 5,292 | 5,311 |

| KMG Kashagan B.V. | 1,169 | 1,253 | 1,344 |

| KMG Karachaganak LLP | 1,015 | 1,094 | 1,034 |

| Indicator | 2019 | 2020 | 2021 |

|---|---|---|---|

| Oil and gas condensate | 485 | 445 | 444 |

| Operating assets | 307 | 279 | 277 |

| JSC OzenMunaiGas | 111 | 106 | 106 |

| JSC Embamunaigas | 58 | 52 | 50 |

| JSC Mangistaumunaigaz | 63 | 59 | 58 |

| JV Kazgermunai LLP | 23 | 16 | 15 |

| JSC Karazhanbasmunai | 20 | 18 | 19 |

| JSC PetroKazakhstan Inc. | 18 | 14 | 16 |

| Kazakhoil Aktobe LLP | 7 | 6 | 6 |

| Kazakhturkmunay LLP | 8 | 9 | 9 |

| Megaprojects | 178 | 166 | 168 |

| Tengizchevroil LLP | 130 | 115 | 116 |

| KMG Kashagan B.V. | 25 | 27 | 29 |

| KMG Karachaganak LLP | 22 | 23 | 22 |

| Indicator | 2021 | ||

|---|---|---|---|

| Production target | Actual output, including OPEC+ cuts | Variance | |

| Oil and gas condensate production | 22,588 | 21,654 | –934 |

| Operating assets | 14,471 | 13,965 | –506 |

| Megaprojects | 8,117 | 7,688 | –436 |

| Assets | Porosity | API density | Sulphur content, % | Number of fields | Average flow rate of new wells, tonnes/day | Average flow rate of current producing well stock, tonnes/day | Oil barrelisation ratio, bbl/tonne |

|---|---|---|---|---|---|---|---|

| Ozenmunaigas | 0.19 | 36.51 | 0.14 | 2 | 11.2 | 4.2 | 7.23 |

| Embamunaygas | 0.27 | 32.03 | 0.62 | 33 | 12.2 | 3.7 | 7.3 |

| Karazhanbasmunai | 0.32 | 19.81 | 2.00 | 1 | 2.13 | 2.13 | 6.68 |

| Kazgermunai | 0.26 | 39.95 | 0.1 | 5 | 19.5 | 28.3 | 7.38 |

| Petro Kazakhstan Inc. | 0.09-0.30 | 51.25 | 0.03-0.08 | 19 | 11-18.2 | 0.9-30.4 | 7.75 |

| Mangistaumunaigaz | 0.14 | 30.77 | 0.2 | 15 | 9.7 | 5 | 7.23 |

| Kazakhoil Aktobe | 0.085 | 38.89 | 1.12 | 2 | 45.3 | 16.3 | 7.516 |

| Kazakhturkmunay | 0.14 | 36.12 | 3.17 | 6 | - | 39.4 | 7.21 |

| Urihktau Operating | 0.1 | 41.7 | 0.7 | 3 | 46.5 | 75.1 | 7.717 |

The technical characteristics of the produced oil differ significantly from region to region. The heaviest oil is produced in Karazhanbasmunai, with a bbl ratio of 6.68 bbl. per ton. The lightest at PetroKazakhstan Inc. with a bbl ratio of 7.75 bbl. per ton.

The quality of crude oil can be determined by two main parameters: high API gravity and low sulfur content. The sulfur content of the CPC Blend brand (KMG's main megaprojects) is 0.56%, the density in API degrees is 45.3, thus it can be considered as one of the best oil in the world in terms of quality.

| Crude oil brand | API Gravity | Sulfur content, % |

|---|---|---|

| CPC Blend (Kazakhstan, Novorossiysk) | 45.3 | 0.56 |

| West Texas Int. (USA, Cushing) | 40.0 | 0.42 |

| Arab Extra Light (Saudi Arabia) | 39.4 | 1.09 |

| Brent (UK) | 37.5 | 0.40 |

| Urals (Russia, Novorossiysk) | 31.3 | 1.36 |

Data is from open sources of S&P Global Platts

Megaprojects

KMG develops world-class projects through partnerships with international oil and gas companies.

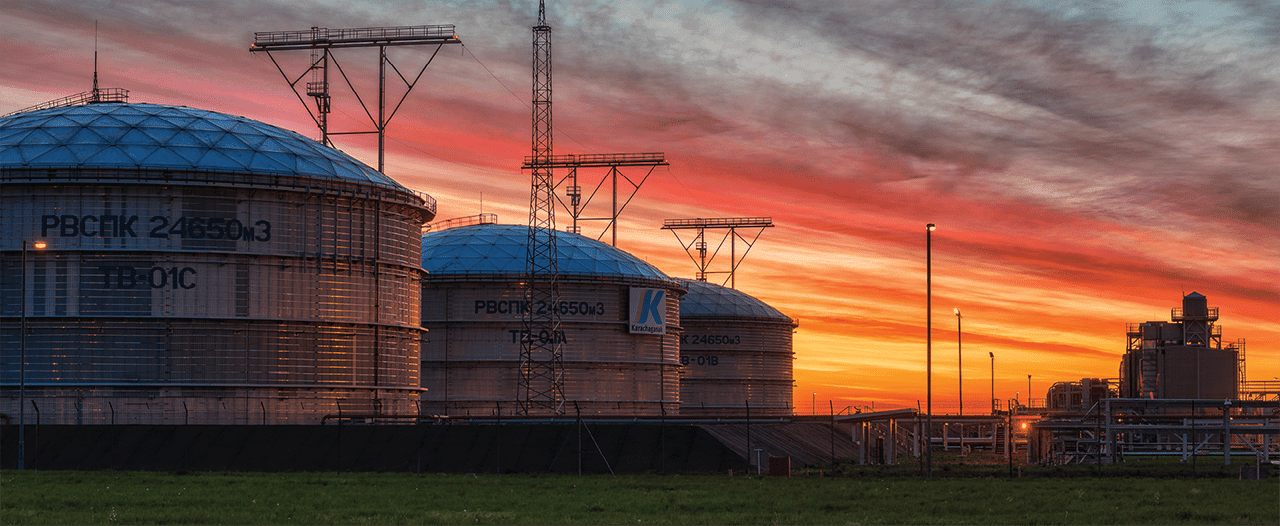

Tengiz

The largest gem in Kazakhstan’s oil and gas industry, a unique supergiant oil field unrivalled elsewhere in the world.

The agreement on Tengizchevroil LLP was signed between the Republic of Kazakhstan and Chevron Corporation on 2 April 1993, with a

Tengizchevroil LLP (TCO) operates a licence that includes the unique supergiant Tengiz field and the adjacent Korolevskoye field with significant reserves. The Tengiz oil field was discovered in 1979. It is the world’s deepest supergiant oil field.

Currently, oil is produced and processed by highly reliable modern operating facilities, including complex technology lines (CTL, 13.48 mln tonnes of oil processed in 2021), Second-Generation Plant (SGP, 13.07 mln tonnes of oil processed in 2021) and sour gas injection unit (SGI, 2.98 bln m3 of gas handled in 2021). The well stock currently comprises 200 production wells and 8 gas injection wells.

In 2021, oil output increased by 0.4%

| Oil production (total) | 26,553 ths tonnes (580 ths bbl per |

| Oil production (attributable to KMG) (20%) | 5,311 ths tonnes (116 ths bbl per day) |

| Outlook | Implementation of the USD 45.2 bln Future Growth Project / Wellhead Pressure Maintenance will boost oil production from the Tengiz field by 12 mtpa |

| 2P oil reserves life | Over 20 years |

| Associated gas production (total), including gas consumed in own operations and gas reinjection | 14.8 bln m3 |

| Interests | KMG (20%), Chevron (50%), ExxonMobil (25%), LUKOIL (5%) |

| Operator | Tengizchevroil LLP |

| Year | Oil production, ths tonnes | Associated gas production, mln m3 | Dry gas production, mln m3 | Liquefied petroleum gas (LPG) production, ths tonnes | Sulphur production, ths tonnes | Gas injection, mln m3 |

|---|---|---|---|---|---|---|

| 2019 | 29,791 | 16,290 | 9,471 | 1,348 | 2,589 | 3,655 |

| 2020 | 26,457 | 14,748 | 8,674 | 1,482 | 2,451 | 3,069 |

| 2021 | 26,480 | 14,767 | 8,717 | 1,449 | 2,493 | 2,982 |

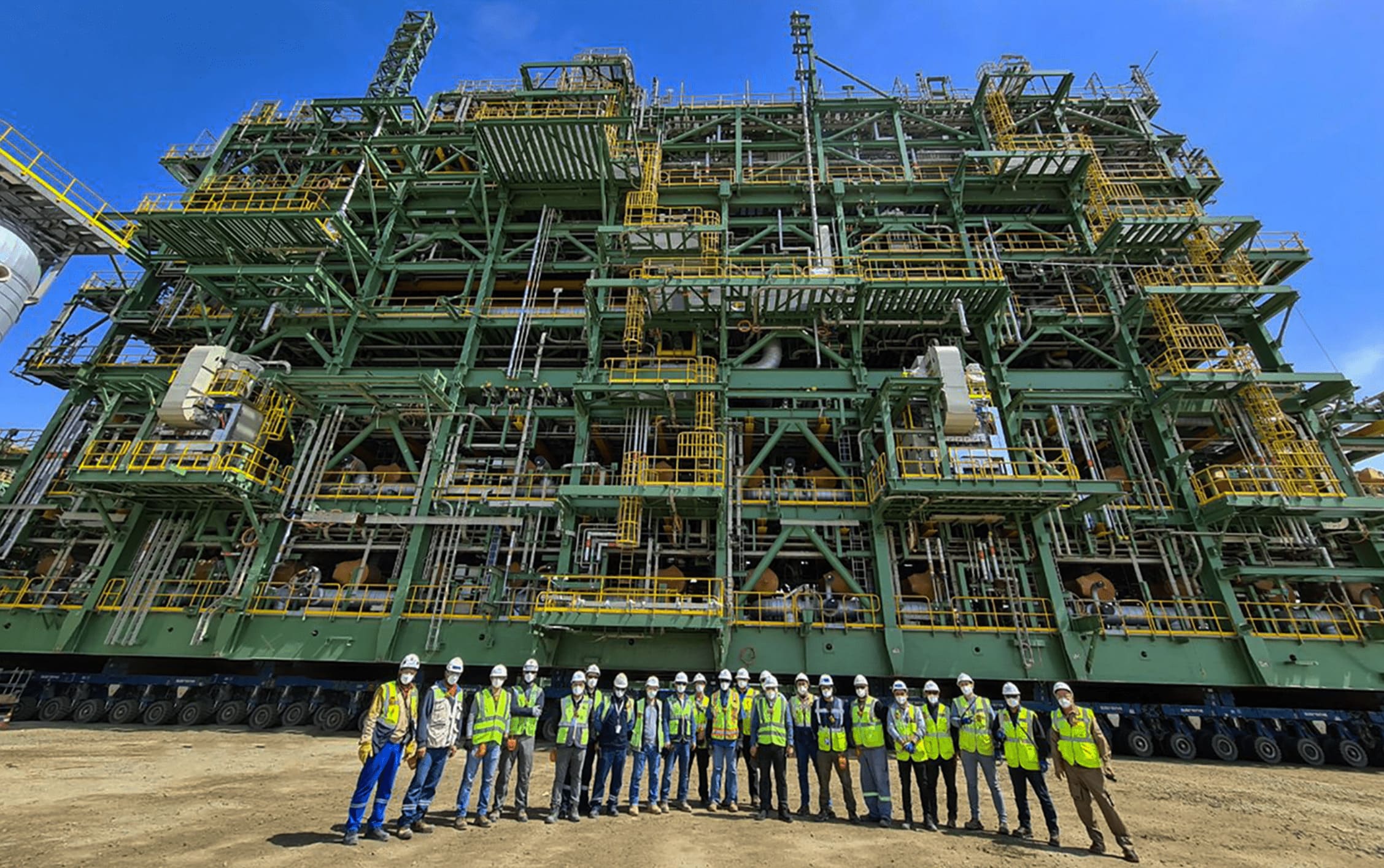

Progress on the Future Growth Project and the Wellhead Pressure Management Project

Tengizchevroil is implementing two integrated projects – the Future Growth Project (FGP) and the Wellhead Pressure Management Project (WPMP). The two projects make a significant contribution to the national economy:

At the end of 2021, the total cost of FGP–WPMP was USD 38.3 bln, with the overall project progress at 89%. Under the updated 2021 schedule, the launch of the WPMP and FGP facilities is slated for March 2023 and November 2023, respectively.

As at 1 January 2022, general construction progress was 82.6% (target – 81.9%), engineering design – 100.0% (target – 100.0%), management systems and power supply – 97.1% (target – 99.5%), well drilling – 94,6% (target – 94.2%), logistics – 100%, procurement – 100% (target – 100%), module manufacturing – 100%, systems completion – 12.5% (target – 17.7%).

All process modules have been placed on the foundations, construction and installation for the Single Centre for Process Management have been completed, and new group metering stations have been commissioned (GZU-53 and GZU-54 in February and September, respectively).

In Q1 2022, Tengizchevroil and the Partners plan to assess the project schedule and costs based on the 2021 progress, with the final dates for FGP facilities commissioning to be announced in Q2 2022.

Works scheduled for 2022:

- Migrating and launching the Single Centre for Process Management

- Commissioning GZU-55

- Supplying fuel gas for pre-commissioning at FGP energy assets

- Completing construction and installation at the Third Generation Raw Gas Injection power plants

- Powering the Third Generation Raw Gas Injection power plants

- Completing mechanical works to lay Pressure Maintenance System pipelines

- Completing works to lay Pressure Maintenance System cables

- Completing construction and installation at raw gas injection drilling sites

- Completing mechanical works to install a demineralised water unit and waste heat boilers at 3GP

COVID-19

Because of the COVID-19 spread on the Tengiz territory and recurring outbreaks between June 2020 and August 2021, around 35,000 employees working at the field and the FGP–WPMP construction sites had to be repeatedly put on leave and brought back. Starting September 2021, the coronavirus situation began stabilising, and currently approximately 32,000 employees are working on FGP–WPMP construction.

By now, over 100,000 people have been vaccinated, out of whom 4,300 are Tengizchevroil employees, and the rest are contractors. Employee revaccination is now underway, with more than 1,800 people having already received booster shots.

As at the end of 2021, 49,000 people were working at the Tengiz field.

Additionally, a 200-bed modular hospital in Kulsary was commissioned.

Kashagan

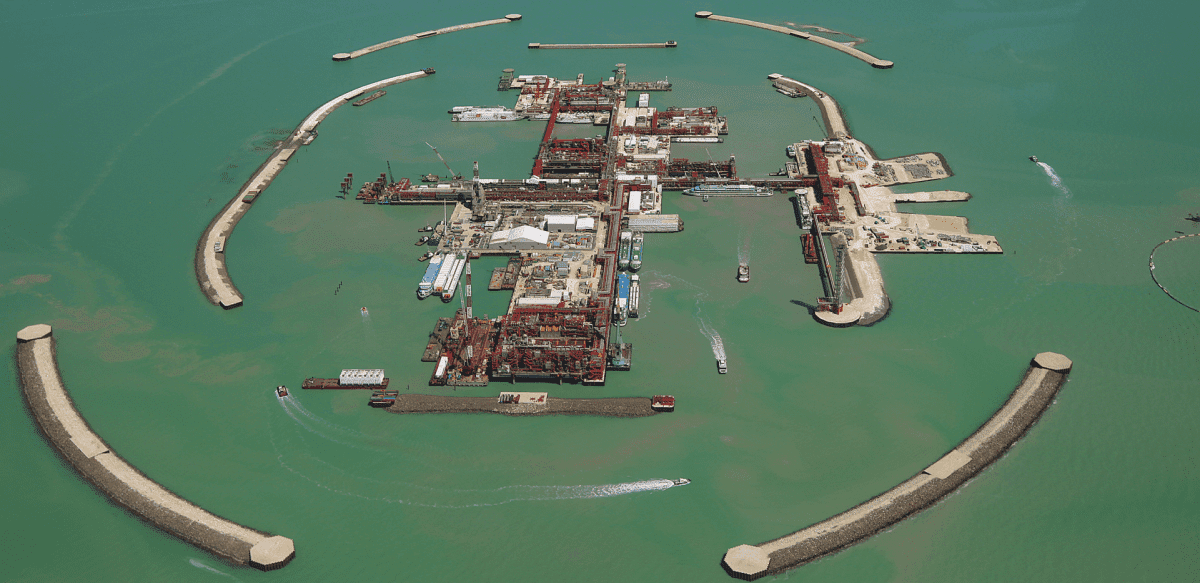

The huge Kashagan field is the largest discovery in recent four decades. Kashagan is one of the most complex projects in the industry globally.

The Production Sharing Agreement in respect of the North Caspian Sea (NCSPSA) was signed by the Republic of Kazakhstan and an international consortium in November 1997. North Caspian Operating Company N.V. is the project operator, acting on behalf of the project contractors.

The North Caspian project is the first major offshore oil and gas project in Kazakhstan. It includes five fields: Kashagan, Kalamkas-Sea, Kairan, Aktoty and Kashagan South-West.

The Kashagan field lies in an offshore location 75 km from Atyrau at water depths of 3 to 4 m. The field reservoir lies at a depth of over 4 km and is characterised by high pressures (over 700 bar) and high hydrogen sulphide (H2S) concentration. At the same time, sour gas reinjection at high pressure improves oil recovery.

Kashagan is one of the most challenging industry projects globally due to harsh environmental conditions at sea and significant design, logistics and safety challenges. Located in the subarctic climate, the North Caspian Sea is covered with ice for about five months a year, requiring innovative technical solutions. KMG, together with international partners, is successfully implementing the project, having achieved sustainable production rates with further growth potential.

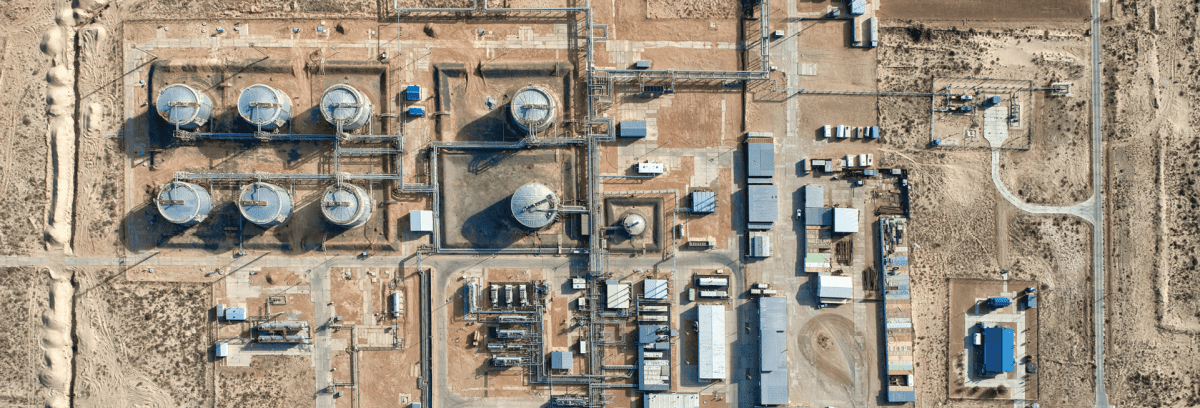

The Kashagan field infrastructure comprises onshore and offshore facilities. Onshore facilities include the Bolashak Onshore Processing Facility (an integrated oil and gas treatment plant) while the offshore facilities comprise a range of manmade structures including an operations and process complex on Island D, Island A, and early production islands EPC-2, EPC-3 and EPC-4. A total of 40 wells were drilled on the Kashagan field, 6 of which are injection wells and 34 are production wells.

Currently, KMG (through Cooperative

| Oil and condensate production in 2021 (total) | 16,2 mln tonnes |

| Oil and condensate production net to KMG (8.44%) | 1,344 ths tonnes (29 kbopd) |

| 2P oil and condensate reserves lifeReflects the current relatively low oil production level, which has an upside potential. | Over 120 years |

| Gas production (total) | 9.9 bln m3 |

| Interests | North Caspian Operating Company N.V. (16.88%), Eni (16.81%), ExxonMobil (16.81%), Shell (16.81%), TOTAL SA (16.81%), CNPC (8.33%), and INPEX North Caspian Sea (7.56%) |

| Operator | North Caspian Operating Company N.V. (NCOC) |

| Year | Oil production, ths tonnes | Natural and associated gas production, mln m3 | Sulphur production, ths tonnes | Gas injection, mln m3 |

|---|---|---|---|---|

| 2019 | 14,127 | 8,453 | 1,323 | 3,148 |

| 2020 | 15,141 | 9,152 | 1,228 | 3,807 |

| 2021 | 16,236 | 9,878 | 1,372 | 4,315 |

In 2021, oil and gas production from the North Caspian project stood at 16.2 mln tonnes and 9.9 bln m3, respectively. Kashagan production grew by 7.2%

Under the terms of the Production Sharing Agreement (PSA), all oil produced at the Kashagan field is exported, including KMG’s share of the oil. The produced oil is mostly exported to Europe, East Asia and India via Novorossiysk, where the oil is delivered by the CPC pipeline.

Outlook for Kashagan

Once sustainable production rates are achieved, two projects are under consideration in phase 1 to ramp up to plateau production with the potential to grow oil and condensate production to 450 kbopd (57 ths tonnes per day) in the medium term.

- Bundle 1

- Project to supply raw gas to a third party. (Gas processing plant (GPP) with a capacity of 1 bln m3 per year).

Two separate projects, A and B, are considered for phase 2 to increase oil and condensate production to 700 kbopd (88 ths tonnes per day) over the next 10 years.

- Phase 2A.

- Phase 2B.

Bundle 1

The project will enable oil production increase

Project to supply raw gas to a third party (Gas Processing Plant (GPP) with a capacity of 1 bln m3 per year)

The project will provide for increasing oil production

Phase 2A

The project seeks to increase oil production to 500,000 kbopd (63 ths tonnes per day at existing facilities, through additional supplies of ~ 2 bln m3 per year of raw gas to JSC National Company QazaqGaz. The project is now at the FEED stage. An FID is expected in 2023, with the project

Phase 2B

The project aims to increase oil production to 700 kbopd (88 ths tonnes per day). An option to build

COVID-19

As part of its

Karachaganak

One of the world’s largest gas and condensate fields

The Final Production Sharing Agreement (FPSA) in respect of the Karachaganak oil and condensate project was signed by the Republic of Kazakhstan and an international consortium on 18 November 1997. Royal Dutch Shell and Eni are the joint operators of the Karachaganak project (development via Karachaganak Petroleum Operating B.V.).

| Production of liquid hydrocarbons | 10.3 mln tonnes |

| Production of liquid hydrocarbon (stab.) net to KMG (10%) | 1,034 ths tonnes (25 kbopd) |

| Outlook | The implementation of investment projects to maintain the achieved liquid hydrocarbon production plateau levels |

| 2P oil and condensate reserves life | Over 20 years |

| Gas production (total) | 18.9 bln m3 |

| Interests | KMG (10%), Eni (29.25%), Shell (29.25%), Chevron (18.00%) and LUKOIL (13.5%) |

| Operator | Royal Dutch Shell and Eni are the joint operators of the Karachaganak field (Karachaganak Petroleum Operating B.V.) |

| Year | Gas production, mln m3 | Liquid hydrocarbon production, ths tonnes | Gas injection, mln m3 |

|---|---|---|---|

| 2019 | 18,615 | 10,147 | 8,711 |

| 2020 | 20,214 | 10,941 | 10,362 |

| 2021 | 18,980 | 10,338 | 9,998 |

Karachaganak oil and condensate field is one of the largest oil and condensate fields in the world, located in the West Kazakhstan Region and covering an area of over 280 sq km. The field was discovered in 1979, with pilot development started in 1984.

The Karachaganak project has three core process facilities, comprising a single system of interrelated and interdependent process units within the Karachaganak field’s production process:

- KPC – the Karachaganak Processing Complex, located in the northwestern part of the field and processing liquid hydrocarbons coming from wells as well as feedstock transported from Unit 2;

- Unit 2 – a gas treatment unit located in the southeastern part of the field, which separates and reinjects raw gas at high pressure and feeds liquid hydrocarbons to the KPC for stabilisation before shipment for export;

- Unit 3 – a gas treatment unit located in the northeastern part of the field, which separates and partially stabilises liquid hydrocarbons and gas before shipment for export.

In 2021, the field’s operating well stock was 158 wells and 19 injection wells.

Liquid hydrocarbon production from Karachaganak decreased by 5.5% year-on-year to 10,338 ths tonnes in 2021, including KMG’s share at 1,034 ths tonnes. Gas production was down 6.1% year-on-year at 18,980 mln m3 in total, with KMG’s share at 1,898 mln m3. The decline was mainly caused by a reduction in raw gas intake by the Orenburg GPP, which is supplied under a long-term gas purchase and sale contract and by long unscheduled maintenance.

Outlook for Karachaganak

The Karachaganak oil and condensate field is in Phase 2 commercial development (phase 2M), which includes a number of major capex projects (Production Plateau Extension Projects and the Karachaganak Expansion Project) aimed at increasing raw gas treatment and reinjection capacity to extend the duration of the liquid hydrocarbon production plateau at the achieved rates.

Production Plateau Extension Projects (phase 2M):

- Installation of the additional 5th Trunk Line (5TL) – the project will increase the annual volume of gas injection to 10 bln m3 in order to maintain reservoir pressure and add 2.6 mln tonnes of liquid hydrocarbons in incremental production over the remaining life of the FPSA. It was commissioned in December 2019.

- KPC Gas Debottlenecking (KGDBN) – the project envisages commissioning of new glycol gas-dehydration and low-temperature gas separation units with a total capacity of 4.0 bln m3 per year to increase the volume of gas treatment for reinjection and/or export to the Orenburg Gas Processing Plant (OGPP), as well as add 9.1 mln tonnes of liquid hydrocarbons in incremental production over the remaining life of the FPSA. It was put into operation in April 2021.

- Installation of Unit 2 4th Injection Compressor (4ICP) – the project will install a network of process pipelines to maintain reservoir pressure and the liquid hydrocarbon production plateau by increasing annual gas injection volumes from 10 bln m3 to 13 bln m3, as well as add 6.8 mln tonnes of liquid hydrocarbons in incremental production over the remaining life of the FPSA. Commissioning is scheduled for March 2022.

- Installation of the additional 6th Trunk Line (6TL) – the project will optimise the injection process by shifting gas to new parts of the field while adding 2.2 mln tonnes of liquid hydrocarbons in incremental production over the remaining life of the FPSA. Commissioning is scheduled for March 2024.

Combined, the Production Plateau Extension Projects will maximise the benefits through:

- increased gas treatment capacity;

- incremental liquid hydrocarbon production;

- upgrades to existing liquid hydrocarbon treatment units;

- reduced rates of reservoir pressure declines.

Karachaganak expansion Project (KEP)

A major expansion of production units is an option to further extend production plateau post phase 2M. This expansion is to be implemented in phases in 2025–2026. The KEP project which will enable a further boost in gas treatment and reinjection capacities through the phased commissioning of the 5th and 6th injection compressors to sustain oil production at 10 mln to 11 mln tonnes per year. The project cost is estimated at USD 1.8 bln. In December 2020, a final investment decision was taken for the 5th Injection Compressor Project (5ICP), and a FID for the 6th Injection Compressor Project (6ICP) is expected in Q3 2022.

Digital projects to transform operations

As part of the Digital Kazakhstan innovative development state programme, Karachaganak Petroleum Operating B.V. has developed a roadmap for a digital transformation and technology innovation. The current work streams are focused on the areas of production optimisation, well surveillance, smart plant and digital transformations for project delivery, minimisation

Digitising key field parameters will enable Karachaganak Petroleum Operating B.V. to make timely decisions maximising productivity through automated integrated data analysis tools. With progress at 65%, the project’s expected completion year is 2022.

COVID-19

COVID-19 response at the Karachaganak field included the following crisis response measures implemented early on:

- suspension of drilling until September 2021;

- curtailing well operations not using drilling rigs, postponing

non-essential well operations from 2020 to 2021; - partially postponing preventive maintenance activities from 2020 to 2021;

- shifting employees to work from home;

- increased shifts for Karachaganak Petroleum Operating B.V. employees and contractor personnel;

- regular PCR tests for Karachaganak Petroleum Operating B.V. employees and contractor personnel;

- frequent cleaning and sanitation protocols, etc.

By the beginning of 2022, the number of vaccinated employees at Karachaganak Petroleum Operating B.V. was around 3,500 persons, or 92%.

Oil production at operating assets

As a legacy of more than a hundred years in the oil and gas industry, KMG’s producing asset portfolio consists mostly of mature fields. In this regard, KMG’s key priority is to improve production efficiency. The Company is committed to energy saving across operations while also maintaining a strong focus on continuous production process optimisations and improvements and driving higher oil recovery rates.

Today about 85% of total oil production at the Company’s operating assets comes from seven key fields: Uzen and Karamandybas (JSC OzenMunaiGas), Kalamkas and Zhetybai (JSC MangistauMunaiGaz), S. Nurzhanov and East Moldabek (JSC Embamunaigas) and Karazhanbas (JSC Karazhanbasmunai).

In 2021, construction and installation works continued on the stage 2 facilities of Phase 1, namely "Construction of a

In 2021, KMG’s share in the oil production of the operating assets decreased by 152 ths tonnes to 13,961 ths tonnes (or 277 kbopd). This reflects a natural decline in production from mature fields and the implementation of arrangements reached under the OPEC+ agreement.

In 2021, the total well stock in operation was 15,081 wells, of which 11,206 wells were classified as the current declining well stock. Most of oil and condensate production comes from the current declining well stock.

| Indicator | 2019 | 2020 | 2021 |

|---|---|---|---|

| New wells | 581 | 518 | 475 |

| Current declining well stock, including idle wells | 12,235 462 | 11,961 616 | 11,206 781 |

| Injection wells | 3,748 | 3,338 | 3,400 |

| Total for KMG-operated assets | 16,564 | 15,817 | 15,081 |

| Unit | KZT per tonne | USD per bbl |

|---|---|---|

| JSC OzenMunaiGas | 38,508 | 12.50 |

| JSC Embamunaigas | 31,694 | 10.34 |

| JSC Mangistaumunaigaz | 23,696 | 7.69 |

| JV Kazgermunai LLP | 11,869 | 3.62 |

| Kazakhturkmunay LLP | 19,212 | 6.26 |

| Kazakhoil Aktobe LLP | 13,986 | 4.26 |

| JSC Karazhanbasmunai | 39,651 | 13.3 |

| Exports | Domestic market | |

|---|---|---|

| Unit | USD per bbl | USD per bbl |

| JSC OzenMunaiGas | 36.30 | 16.95 |

| JSC Embamunaigas | 37.65 | 16.87 |

| JSC Mangistaumunaigaz | 32.56 | 16.29 |

| JV Kazgermunai LLP | 38.55 | 19.07 |

| Kazakhturkmunay LLP | 39.25 | 8.10 |

| Kazakhoil Aktobe LLP | 38.90 | 18 |

| JSC Karazhanbasmunai | 39.22 | 12.91 |

Gas production

Natural and associated gas production decreased by 0.7% to 8,135 mln m3 in 2021. Operating assets produced 2,466 mln m3 (30% of the total), and 5,669 mln m3 (70%) came from megaprojects, with the Tengiz and Karachaganak megaprojects accounting for the bulk of production.

Gas production values are the actual volume of gas produced, including gas reinjected for own needs. Gas reinjection is used to maintain reservoir pressure, which is essential for sustaining high oil production rates.

Commercial gas production in 2021 was 4,625 mln m3, of which 1,760 mln m3 were produced from operating assets and 2,865 mln m3 from megaprojects. Year-on-year, commercial gas production decreased by 173 mln m3, or 3.6% cumulatively.

Along with processing own feedstock, the KazGPZ plant produces commercial gas using feedstocks supplied by KMG’s other operating assets that do not produce commercial gas themselves.

| Indicator | 2019 | 2020 | 2021 |

|---|---|---|---|

| Natural and associated gas production by asset (net to KMG), mln m3 | 8,455 | 8,191 | 8,135 |

| Оperating assets | 2,636 | 2,463 | 2,466 |

| JSC OzenMunaiGas | 709 | 726 | 665 |

| JSC Embamunaigas | 260 | 217 | 202 |

| JSC Mangistaumunaigaz | 394 | 334 | 376 |

| JV Kazgermunai LLP | 224 | 188 | 185 |

| JSC Karazhanbasmunai | 27 | 27 | 31 |

| JSC PetroKazakhstan Inc. | 181 | 142 | 125 |

| Kazakhoil Aktobe LLP | 348 | 361 | 412 |

| Kazakhturkmunay LLP | 143 | 140 | 167 |

| Amangeldy Gas LLP | 350 | 326 | 278 |

| Urikhtau Operating LLP | 0 | 2 | 24 |

| Megaprojects | 5,819 | 5,729 | 5,617 |

| Tengizchevroil LLP | 3,258 | 2,950 | 2,953 |

| KMG Kashagan B.V. | 700 | 758 | 818 |

| KMG Karachaganak LLP | 1,861 | 2,021 | 1,898 |

| Indicator | 2019 | 2020 | 2021 |

|---|---|---|---|

| JSC OzenMunaiGas + | 680 | 751 | 636 |

| JSC Mangistaumunaigaz | 116 | 161 | 172 |

| JV Kazgermunai LLP | 184 | 150 | 303 |

| Amangeldy Gas LLP | 346 | 326 | — |

| Kazakhoil Aktobe LLP | 157 | 185 | 383 |

| JSC Embamunaigas | 135 | 152 | 145 |

| Kazakhturkmunay LLP | 163 | 103 | 121 |

| JSC PetroKazakhstan Inc. | 43 | 49.5 | 0 |

| JSC Karazhanbasmunai | 0 | 0 | 0 |

| Total for operating assets | 1,823 | 1,877 | 1,760 |

| Indicator | 2019 | 2020 | 2021 |

|---|---|---|---|

| Tengiz | 1,894 | 1,735 | 1,743 |

| KarachaganakRaw gas supplies to the Orenburg Gas Processing Plant. | 911 | 899 | 818 |

| Kashagan | 293 | 287 | 304 |

| Total for megaprojects | 3,099 | 2,921 | 2,865 |